Easter Holiday & Order Processing Notice

We're on Easter holiday until Tuesday, 22. April 2025. All orders and support enquiries received during this period will be processed & shipped-out in-order after returning from Holiday.

- Stock: In Stock

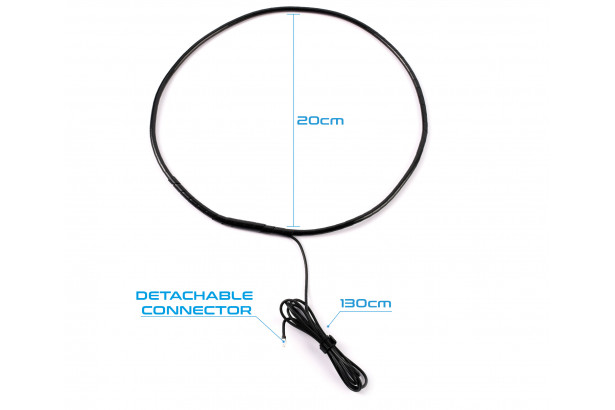

- Model: NL01

EU VAT regulation (since 1.7.2021)

As of 01.07.2021, in B2C distance selling (transactions with end consumers), the previously applicable VAT delivery thresholds in the EU will be abolished and tax amounts will be owed directly in the country of delivery.

The so-called "distance selling regulation" will then apply.

From this point on, cross-border deliveries of goods to non-businesses will be taxable in the destination member state, and the corresponding amount of VAT will be payable there.

This means, for example, that as of 1.7.21, 21% VAT will be shown on invoices for deliveries to Belgium, and 25% VAT will be shown on invoices for deliveries to Sweden. The recipient in Sweden therefore no longer benefits from the 22% VAT rate in Slovenia.

Shipments outside the EU

Shipments to outside the EU are 0% VAT and remain VAT-free. Customs or other import costs for the destination country may apply.

See Payment information for more details.

Shipping

See Delivery information for more details.